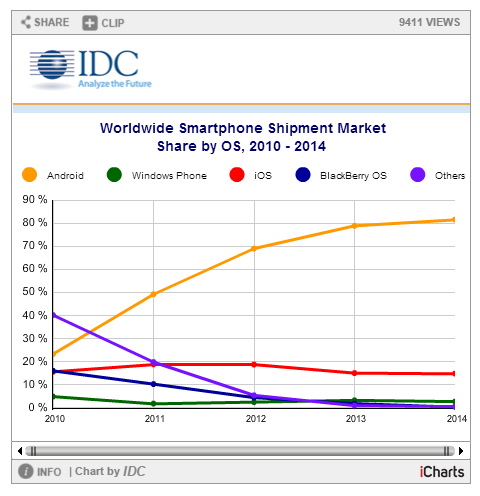

FRAMINGHAM, Mass. February 24, 2015 – Android and iOS inched closer to total domination of the worldwide smartphone market in both the fourth quarter (4Q14) and the calendar year 2014 (CY14). According to data from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, Android and iOS accounted for 96.3% of all smartphone shipments, up slightly from 95.6% in 4Q13 and from 93.8% in CY13. In terms of year-over-year shipment growth, Android outpaced the overall smartphone market for CY14 (32.0% vs 27.7%, respectively) while iOS beat the market in 4Q14 (46.1% vs 29.2%, respectively).

"Many of the same drivers were in play for Android and iOS to tighten their grip on the market," said Ramon Llamas, Research Manager with IDC's Mobile Phone team. "A combination of strong end-user demand, refreshed product portfolios, and the availability of low-cost devices – particularly for Android – drove volumes higher.

"What will bear close observation is how the two operating systems fare in 2015 and beyond," added Llamas. "Now that Apple has entered the phablet market, there are few new opportunities for the company to address. Meanwhile, Samsung experienced flat growth in 2014, forcing Android to rely more heavily on smaller vendors to drive volumes higher."

"Instead of a battle for the third ecosystem after Android and iOS, 2014 instead yielded skirmishes, with Windows Phone edging out BlackBerry, Firefox, Sailfish and the rest, but without any of these platforms making the kind of gains needed to challenge the top two," said Melissa Chau, Senior Research Manager with IDC's Worldwide Quarterly Mobile Phone Tracker.

"This isn't to say that vendors aren't making moves, especially for the growth segments – the low-end markets," continued Chau. "With Microsoft bringing ever-cheaper Lumia into play and Tizen finally getting launched to India early this year, there is still a hunger to chip away at Android's dominance."

Smartphone OS Highlights

Android pushed past the one billion unit mark in 2014, a significant milestone by itself but also because total Android volumes in 2014 bested total smartphone volumes in 2013. Samsung retained the leadership position by a wide margin, shipping more volume than the next five vendors combined. At the same time, Samsung's total volumes for the year remained essentially flat while Asian vendors including Huawei, Lenovo (including Motorola), LG Electronics, Xiaomi, and ZTE fueled the most growth for Google's platform.

iOS saw its market share for 2014 decline slightly even as volumes reached a new record and grew at nearly the same pace as the overall smartphone market. Much of this was due to the strong demand for Apple's new and larger iPhones and the reception they had within key markets. What remains to be seen is how Apple will sustain demand going forward, as larger screens were among the last gaps in its product portfolio.

Windows Phone had the smallest year-over-year increase among the leading operating systems growing just 4.2%, well below the overall market. Having finalized its acquisition of Nokia in the spring of 2014, Microsoft relied primarily on a long list of entry-level Lumia devices to maintain its position in the market, and relied on its partners HTC and Samsung to provide cover on the high-end of the market. With the launch of Windows 10 later this year, Windows Phone stands to make a more concerted effort to return to the high end of the market.

BlackBerry posted the only year-over-year decline among the leading operating systems, falling -69.8% from 2013 levels. 2014 marked a year of rationalization for the beleaguered platform, and by the end of the year the company had revealed multiple enhancements to its platform and new device additions with the BlackBerry Passport and BlackBerry Classic. CEO John Chen anticipates 10 million units will be shipped in 2015, returning the company to profitability and marking a 72% increase over the 5.8 million units shipped in 2014.

Top Four Smartphone Operating Systems, Unit Shipments, Market Share, and Year-Over-Year Growth, Calendar Year 2014 Data (Units in Millions)

| Operating System |

2014 Unit Volumes

|

2014 Market Share

|

2013 Unit Volumes

|

2013 Market Share

|

Year-Over-Year Change

|

| Android |

1,059.3

|

81.5%

|

802.2

|

78.7%

|

32.0%

|

| iOS |

192.7

|

14.8%

|

153.4

|

15.1%

|

25.6%

|

| Windows Phone |

34.9

|

2.7%

|

33.5

|

3.3%

|

4.2%

|

| BlackBerry |

5.8

|

0.4%

|

19.2

|

1.9%

|

-69.8%

|

| Others |

7.7

|

0.6%

|

2.3

|

0.2%

|

234.8%

|

| Total |

1,300.4

|

100.0%

|

1,018.7

|

100.0%

|

27.7%

|

Source: IDC Worldwide Quarterly Mobile Phone Tracker, February 24, 2015

This chart is intended for public use in online news articles and social media. Instructions on how to embed this graphic are available by clicking here.

Top Four Smartphone Operating Systems, Unit Shipments, Market Share and Year-Over-Year Growth, Q4 2014 (Units in Millions)

| Operating System |

4Q14 Unit Volumes

|

4Q14 Market Share

|

4Q13 Unit Volumes

|

4Q13 Market Share

|

Year-Over-Year Change

|

| Android |

289.1

|

76.6%

|

228.4

|

78.2%

|

26.6%

|

| iOS |

74.5

|

19.7%

|

51

|

17.5%

|

46.1%

|

| Windows Phone |

10.7

|

2.8%

|

8.8

|

3.0%

|

21.6%

|

| BlackBerry |

1.4

|

0.4%

|

1.7

|

0.6%

|

-17.6%

|

| Others |

1.8

|

0.5%

|

2.3

|

0.8%

|

-21.7%

|

| Total |

377.5

|

100.0%

|

292.2

|

100.0%

|

29.2%

|

Source: IDC Worldwide Quarterly Mobile Phone Tracker, February 24, 2015

Note:

- Vendor shipments are branded shipments and exclude ODM sales for all vendors. The vendor names reflected in this release represent the current parent company (or holding company) for all brands, regardless of the date of mergers or acquisitions.

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC's Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools. The IDC Tracker Charts app allows users to view data charts from the most recent IDC Tracker products on their iPhone and iPad.

For more information about IDC's Worldwide Quarterly Mobile Phone Tracker, please contact Kathy Nagamine at 650-350-6423 or knagamine@idc.com.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. IDC's analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a subsidiary of IDG, the world's leading technology media, research, and events company. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC.

.jpg)

0 comments:

Post a Comment